Expect global economic expansion to continue in 2018 with subdued inflation

Hong Kong, January 11, 2018 - The global business cycle expansion broadened and strengthened in 2017 and will likely continue to strengthen in 2018, led by improvements in the US and the Eurozone as well as steady contributions from China and India, according to Dr. John Greenwood, Chief Economist of Invesco.

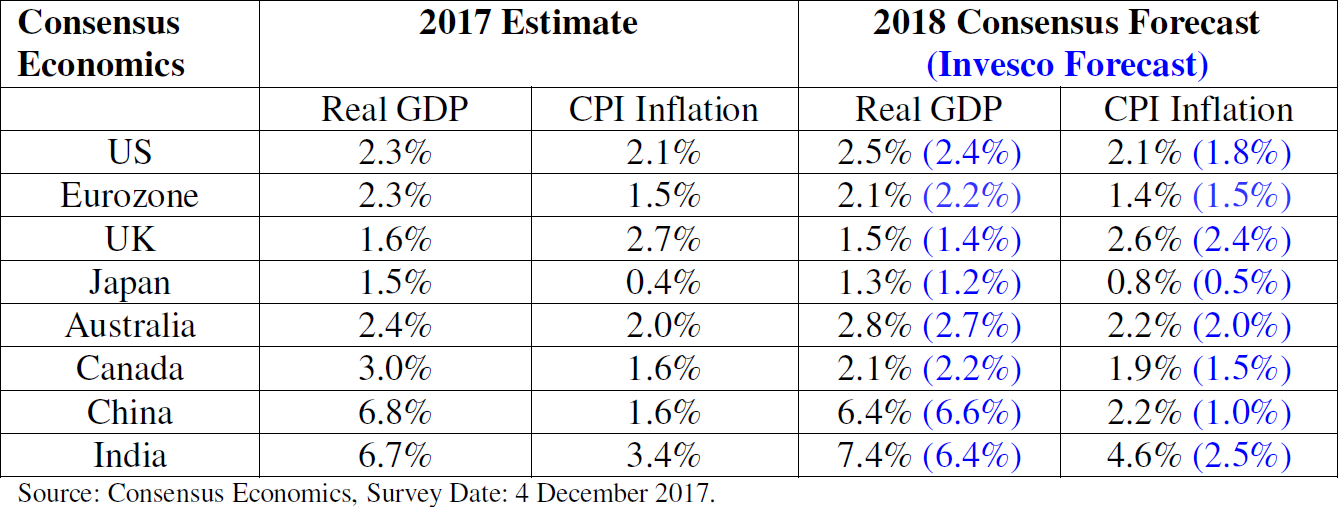

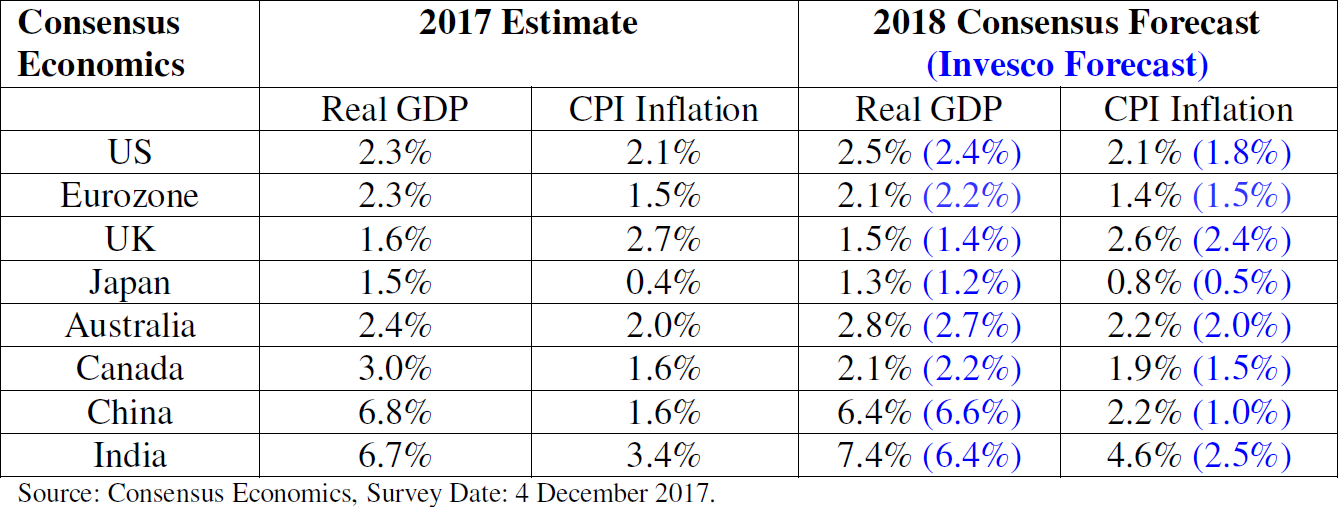

Most emerging economies’ momentum is improving, although in China this momentum has been weakening slightly, led by a mild slowdown in the property sector. Despite this slowdown, Dr. Greenwood expects 6.6% real gross domestic product (GDP) growth in China and 1.0% consumer price inflation in 2018.

“Through last year we witnessed continued reductions in excess capacity in numerous state-owned sectors of the Chinese economy, including in basic industries such as steel, coal and electricity, but the economy continued to improve in the face of these challenges,” said Dr. Greenwood. “Meanwhile credit growth has slowed to its lowest level since the Financial Crisis, and Chinese authorities have kept monetary policy broadly stable through the latest credit surge. These indicators support the view that China is engineering a steady domestic recovery.”

“Another interesting development has been the improvement in both Chinese exports and imports in 2017, which indicate that the prolonged slump in world trade has turned a corner. This should be positive for commodity exporting economies which are dependent on Chinese demand for their raw materials,” Dr. Greenwood added.

Among the East Asian economies, Dr. Greenwood’s view is that the outlook for manufacturing countries that are heavily involved in regional supply chains will depend primarily on the business cycle upswings in the US and Europe. They will depend less so on the domestic Chinese economy, since China imports mainly raw materials and capital goods rather than manufactured goods. Given this continued business expansion in the US and Europe, Dr. Greenwood expects South Korea, Taiwan and Hong Kong to grow at 2-3% in 2018, while the ASEAN economies are expected to grow at 4-5%.

Monetary policy is key to solving the low inflation riddle

In reviewing the global macroeconomic picture, Dr. Greenwood notes that inflation has been running below the target rate of 2% in most developed economies for several years. As such, the conventional economic model which ascribes higher inflation to lower rates of unemployment does not explain how current inflation rates remain relatively low.

Dr. Greenwood explained: “Although advanced economies have had several years of quantitative easing, the commercial banks have not expanded their loans or deposits rapidly, partly due to the need to repair balance sheets, and partly due to stricter regulations. This has slowed the growth of credit, and in turn slowed the growth in money supply. In short, low money growth has resulted in low inflation. As long as this remains the case, so that inflation and inflation expectations also remain low, there is no reason to expect a monetary policy tightening that would threaten to end the business cycle expansion.”

Dr. Greenwood sees further room for improvement in global employment. While unemployment has dropped in most major economies and measures of labor force tightness have increased, participation rates in several countries are low, and many part-time workers would like to be working either longer hours or full-time.

With regards to current asset valuations in the market, Dr. Greenwood asserts that high valuations need not be a threat to economic expansion. “For much of 2017 investors were fearful of a major correction in bond and equity markets, but no obvious buying opportunity presented itself. Now equity and real estate valuations are at elevated levels, but high valuations alone do not produce market setbacks. The current level of asset prices is not based on high leverage but rather extremely low interest rates. As long as central banks raise rates cautiously and the business cycle expansion remains intact, financial markets can continue to discount continued earnings growth for several years ahead.”

Expect continued business cycle expansion in the US

Dr. Greenwood argues that an ongoing gradual upswing of the business cycle is driving the US economic expansion. In line with historical experience, it is business cycle trends that dominate the broad movements of asset prices.

Notably, Dr. Greenwood is confident that the current business cycle expansion, which has been underway for 100 months beginning in June 2009, will continue expanding and break the prior record of longest business expansion in the US over the 10-year period from March 1991 to March 2001.

Elaborating on this expectation, Dr. Greenwood explained: “The reason is that the early years of the expansion were spent repairing balance sheets by deleveraging and recapitalizing and therefore with sub-par growth. Since then growth has improved, but the economy is by no means overheated, either in terms of wages or inflation. Business cycles end not through old age but predominantly by tightening actions by the central bank, and since the Fed has no need currently to undertake such drastic policy measures I remain confident that the present expansion will continue through 2018 and into 2019.”

Dr. Greenwood forecasts US real GDP growth to reach 2.4% in 2018 and consumer price inflation to average 1.8% in 2018.

Recoveries in Eurozone and UK remain fragile

Despite some political headwinds, on the economic front the European economic situation has continued to improve, with economic growth for the area rising to 2.6% year-on-year in the third quarter of 2017. Real GDP has grown an average 2.1% in the three years to Q3 2017, its best and most consistent showing since 2005-08.

The current cycle of economic improvement in the Eurozone is still tenuous. A downturn in credit growth at this stage of the recovery remains a risk, as it would cause the economic upswing to weaken. Meanwhile the inflation rate remains well below the target of “below but close to 2%”, and could decline even further if the European Central Bank tapers its asset purchases.

Meanwhile in the UK, GDP growth last year growth slowed to about 1.5%. Despite the slowdown versus the period prior to the Brexit referendum, some areas of the economy remained strikingly buoyant such as nominal retail sales and industry order books, in addition to continued strength in the labor market. This may be attributed to highly stimulatory monetary policy as well as a weaker pound which has enabled the manufacturing export sector to be much more vigorous than expected, although this has coincided with rising consumer price inflation.

For the Eurozone Dr. Greenwood forecasts real GDP growth in 2018 of 2.2% and headline CPI inflation of 1.5%. For the UK he forecasts 1.4% real GDP growth and 2.4% consumer price inflation.

Appendix

Consensus Forecast Growth in GDP and CPI in Selected Major Economies

About Invesco Ltd.

Invesco is an independent investment management firm dedicated to delivering an investment experience that helps people get more out of life. With nearly 7,000 employees worldwide, Invesco manages US$917.5 billion in assets around the globe, serving clients in more than 120 countries (as of September 30, 2017). Invesco was established in 1935 and today operates in more than 20 countries. The firm is currently listed on the New York Stock Exchange under the symbol IVZ. For further information visit www.invesco.com.