Investment Choices of BCT Strategic MPF Scheme

The philosophy behind the design of the BCT Strategic MPF Scheme is that members have different investment goals, all of which should be catered through appropriate investment choices. Thus, the Scheme offers the Default Investment Strategy and 13 investment choices which include constituent funds with different risk and return profile^ spanning from the more aggressive to the more conservative type.

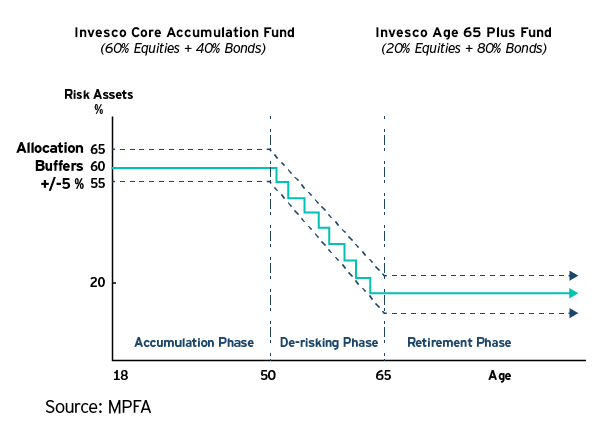

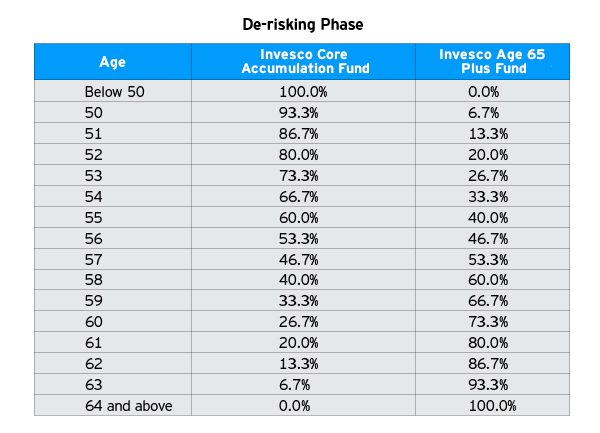

Default Investment Strategy

Default Investment Strategy is a ready-made investment arrangement investing in two Constituent Funds (Invesco Core Accumulation Fund and Invesco Age 65 Plus Fund). As an MPF member approaches retirement age, the investment strategy will be progressively adjusted to reduce the proportion of higher risk assets.

Invesco Hong Kong and China Equity Fund

Investment Objective :

To achieve long-term capital appreciation through investments in Hong Kong and China-related securities.

Risk and return profile^: High

Risk Class*: 7 (As of 31/03/2024)

Invesco Global Index Tracking Fund~

Investment Objective :

To achieve long-term capital growth by investing directly in Invesco MSCI3 World ESG Universal Screened UCITS ETF4.

Risk and return profile^: High

Risk Class*: -

3 The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The Brochure contains a more detailed description of the limited relationship MSCI has with BCT Financial Limited and any related funds.

4 While Invesco MSCI World ESG Universal Screened UCITS ETF is ITCIS approved by the MPFA, it is not offered for sale to the public in Hong Kong.

Investment Objective :

To achieve long-term capital growth by investing directly in the Tracker Fund of Hong Kong ("TraHK")** with a view to

providing investment results that closely corresponds to the performance of the Hang Seng Index of Hong Kong.

Risk and return profile^: High

Risk Class*: 7 (As of 31/03/2024)

**TraHK is an Index-Tracking Collective Investment Scheme approved by the MPFA (the "ITCIS").

Please read the disclaimer in relation to the Hang Seng Index in MPF scheme brochure.

Invesco US Index Tracking Fund~

Investment Objective :

To achieve long-term capital growth by investing directly in Invesco MSCI3 USA ESG Universal Screened UCITS ETF5.

Risk and return profile^: High

Risk Class*: -

3 The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The Brochure contains a more detailed description of the limited relationship MSCI has with BCT Financial Limited and any related funds.

5 While Invesco MSCI USA ESG Universal Screened UCITS ETF is ITCIS approved by the MPFA, it is not offered for sale to the public in Hong Kong.

Invesco Asian Equity Fund

Investment Objective :

To achieve long-term capital appreciation through investments in Asian (excluding Japanese) equities.

Risk and return profile^: High

Risk Class*: 6 (As of 31/03/2024)

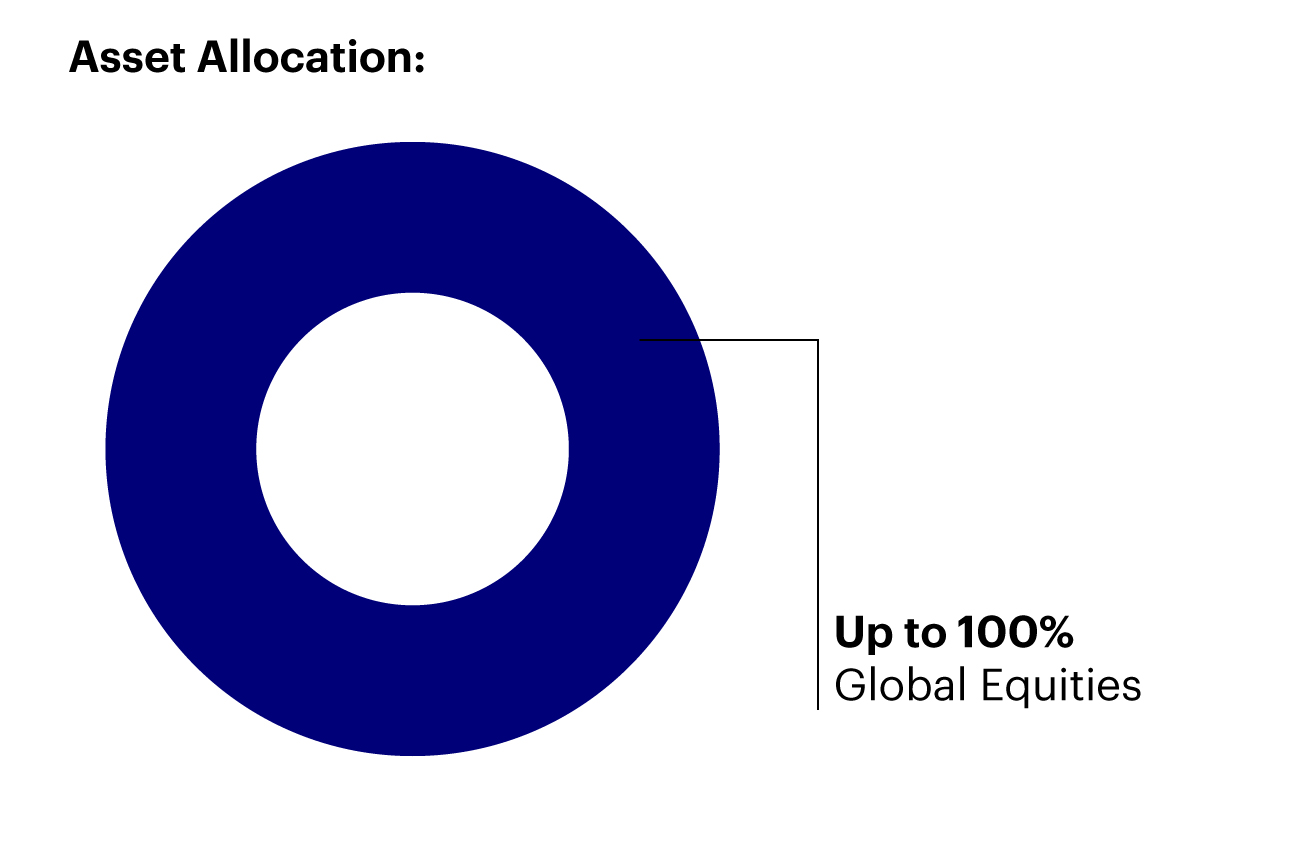

Invesco Growth Fund

Investment Objective :

To achieve long term capital appreciation through investments in global equities.

Risk and return profile^: High

Risk Class*: 6 (As of 31/03/2024)

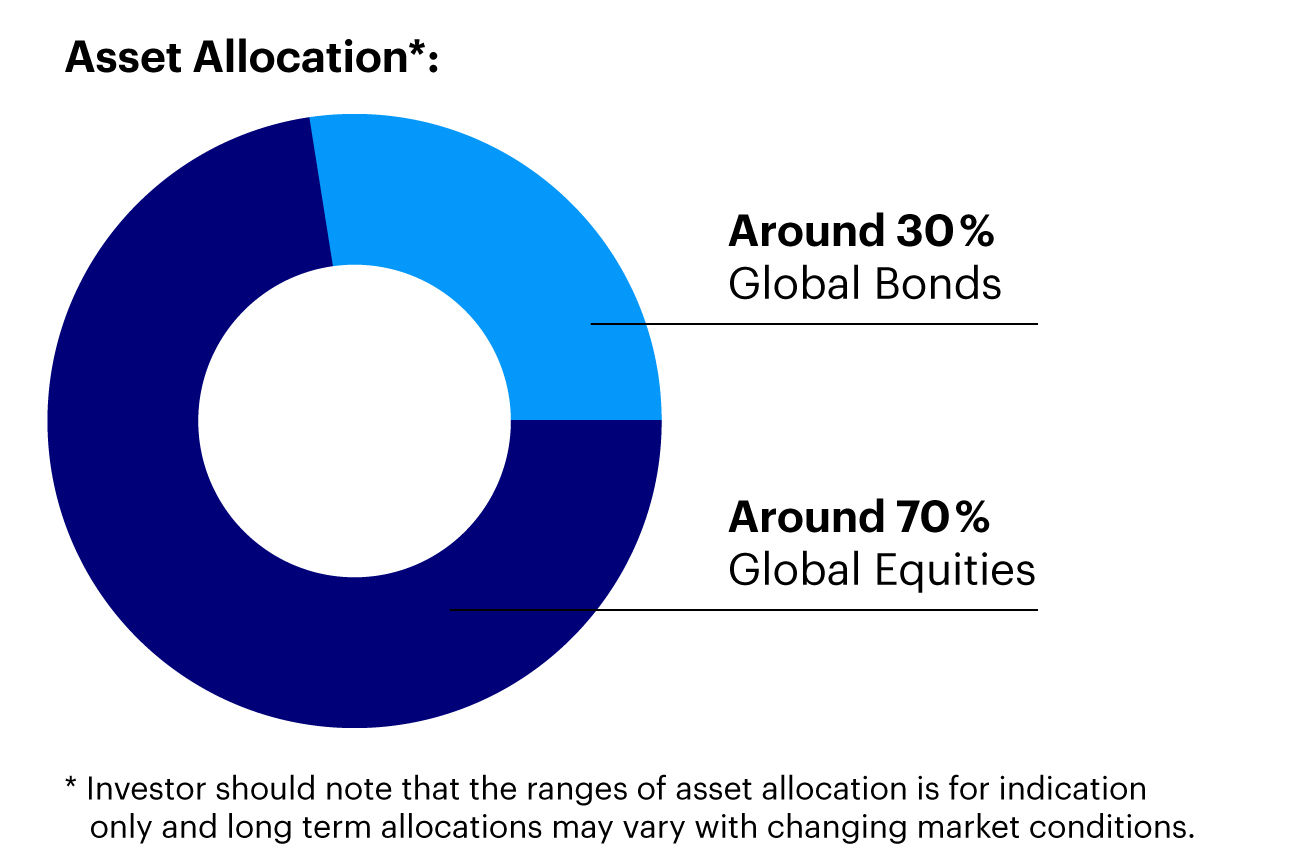

Invesco Balanced Fund

Investment Objective :

To achieve capital appreciation in excess of Hong Kong salary inflation over the long term.

Risk and return profile^: Medium to High

Risk Class*: 5 (As of 31/03/2024)

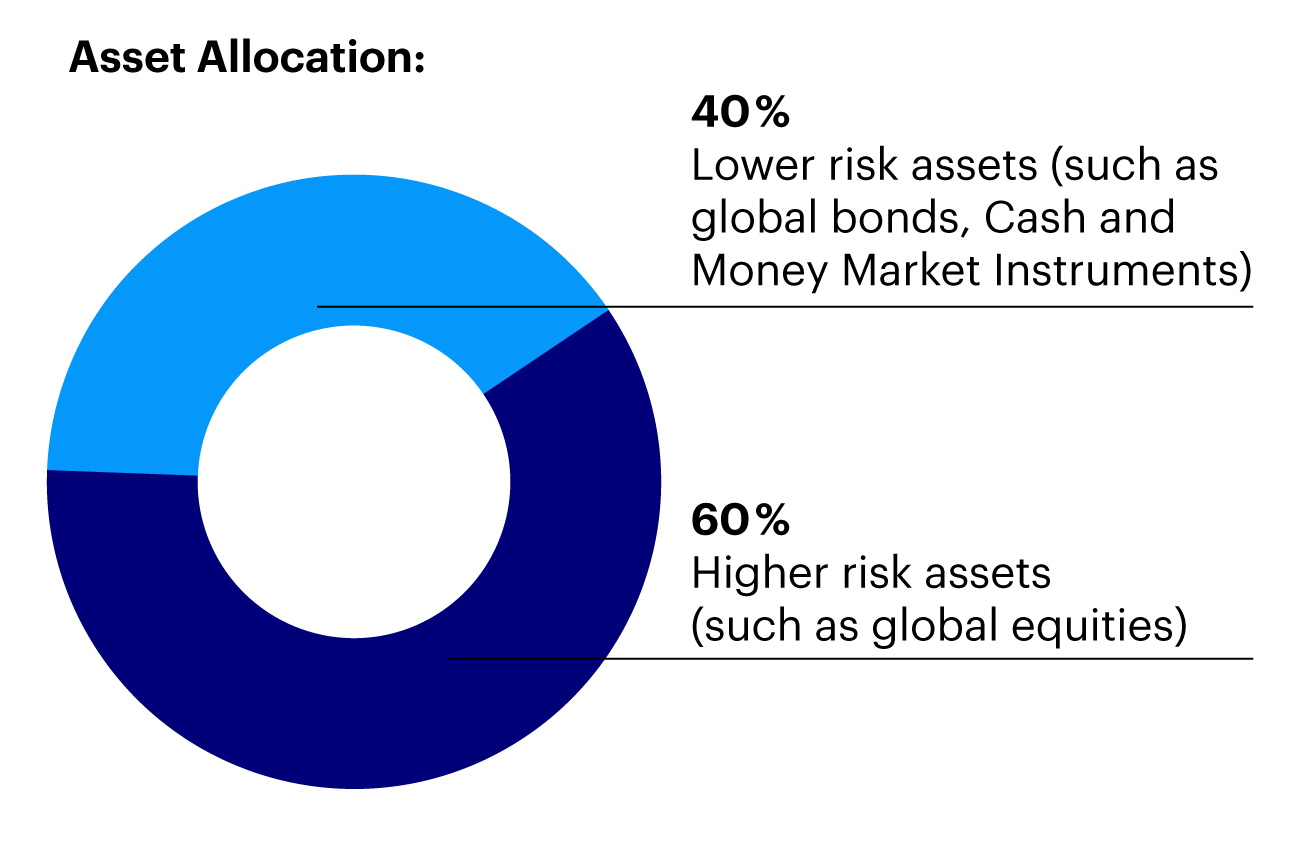

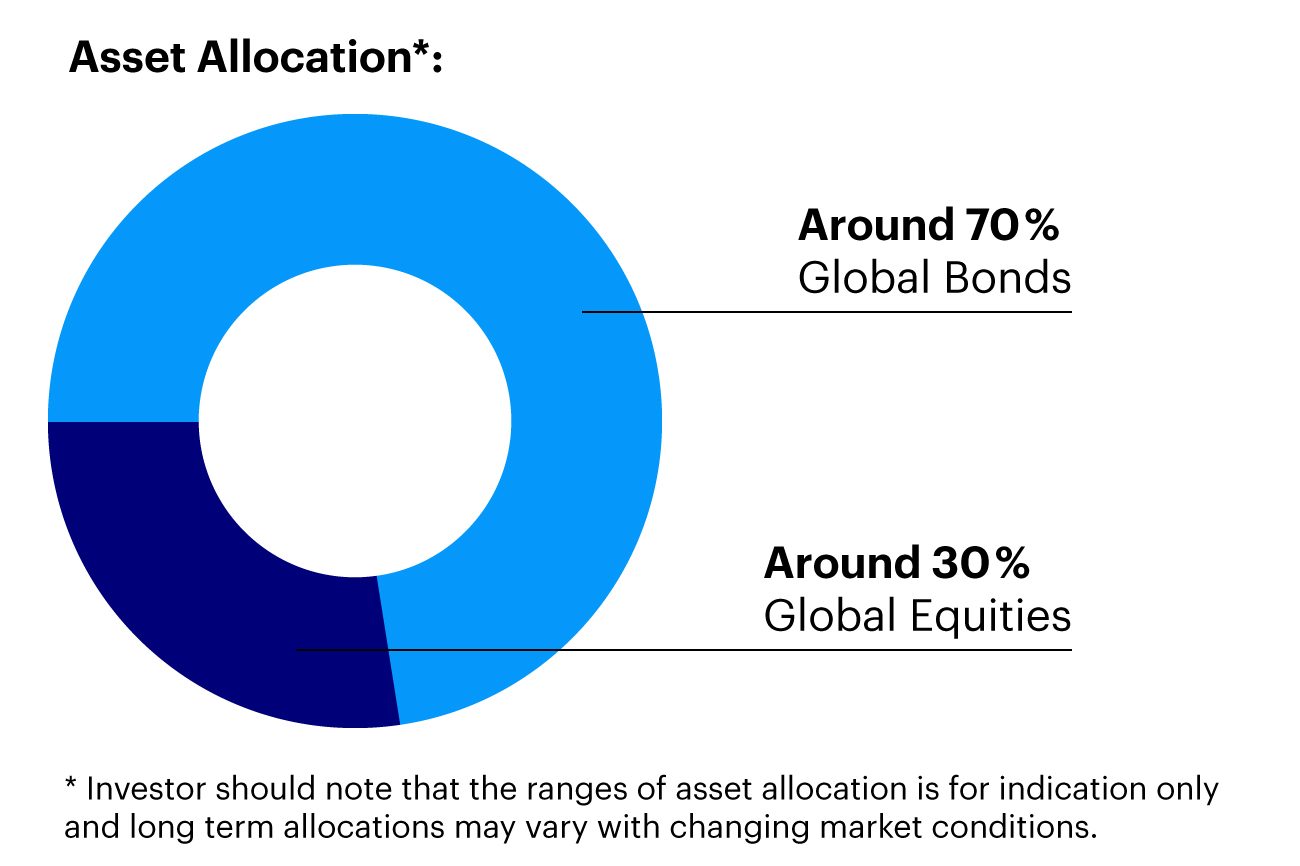

Invesco Core Accumulation Fund

Investment Objective :

To achieve capital growth by investing in a globally diversified manner.

Risk and return profile^: Medium to High

Risk Class*: 5 (As of 31/03/2024)

Invesco RMB Bond Fund

Investment Objective :

To achieve steady growth over the long term by investing primarily into RMB denominated debt instruments and money

market instruments issued or distributed outside and within Mainland China, with a primary focus on RMB denominated

bonds issued in Hong Kong.

Risk and return profile^: Medium

Risk Class*: 3 (As of 31/03/2024)

Invesco Capital Stable Fund

Investment Objective :

To achieve capital preservation over the long term while seeking to enhance returns through limited exposure to global

equities.

Risk and return profile^: Low to Medium

Risk Class*: 4 (As of 31/03/2024)

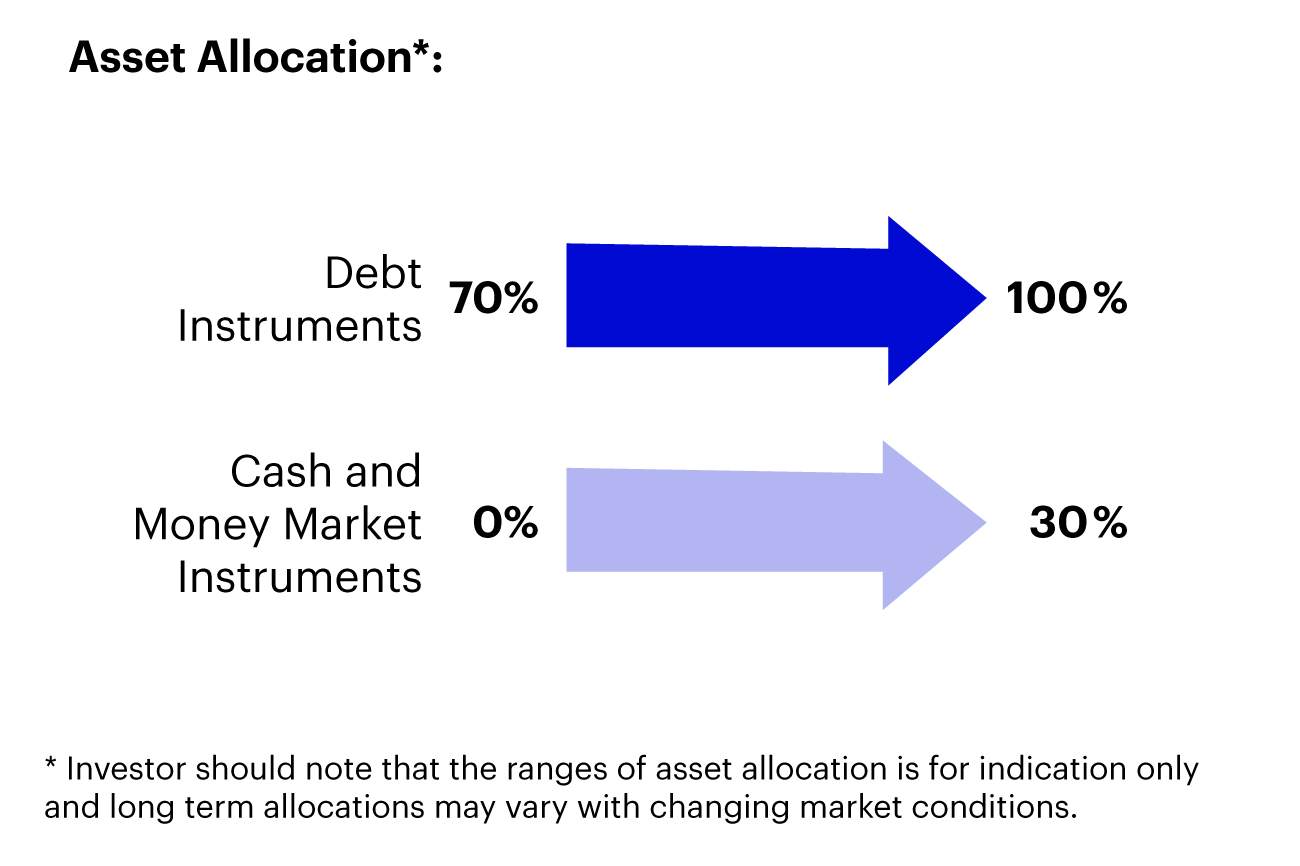

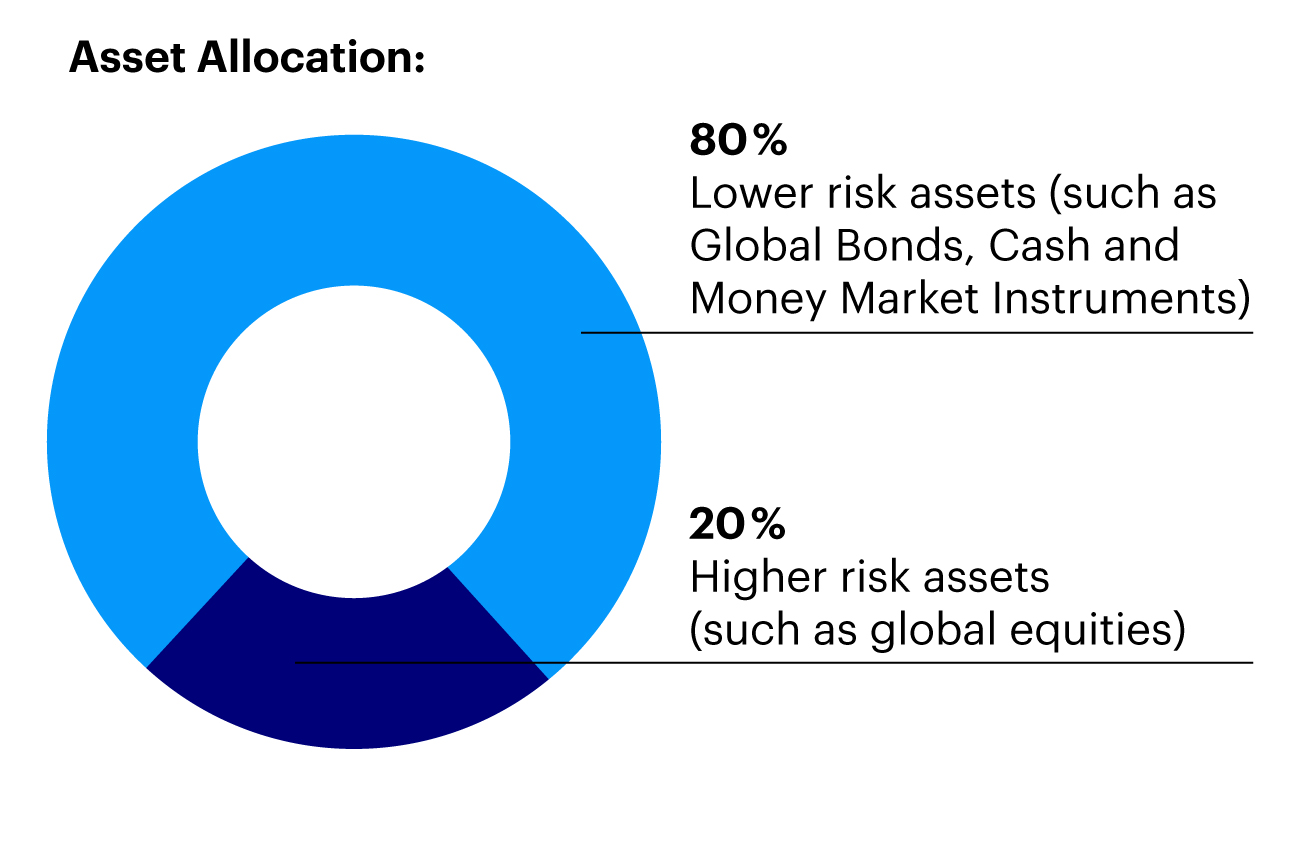

Invesco Age 65 Plus Fund

Investment Objective :

To achieve stable growth by investing in a globally diversified manner.

Risk and return profile^: Low to Medium

Risk Class*: 4 (As of 31/03/2024)

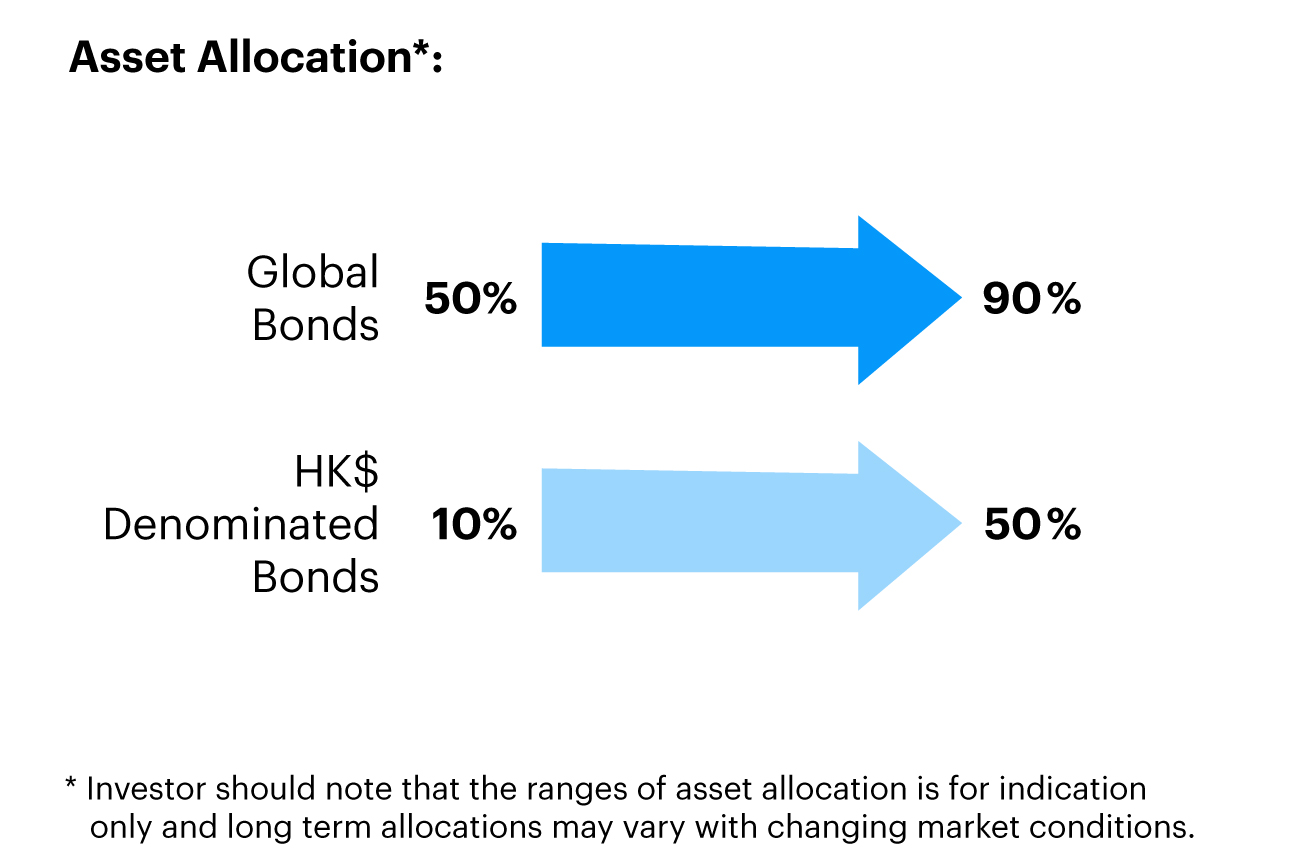

Invesco Global Bond Fund

Investment Objective :

To achieve steady growth over the long term through investments in global bonds.

Risk and return profile^: Low

Risk Class*: 4 (As of 31/03/2024)

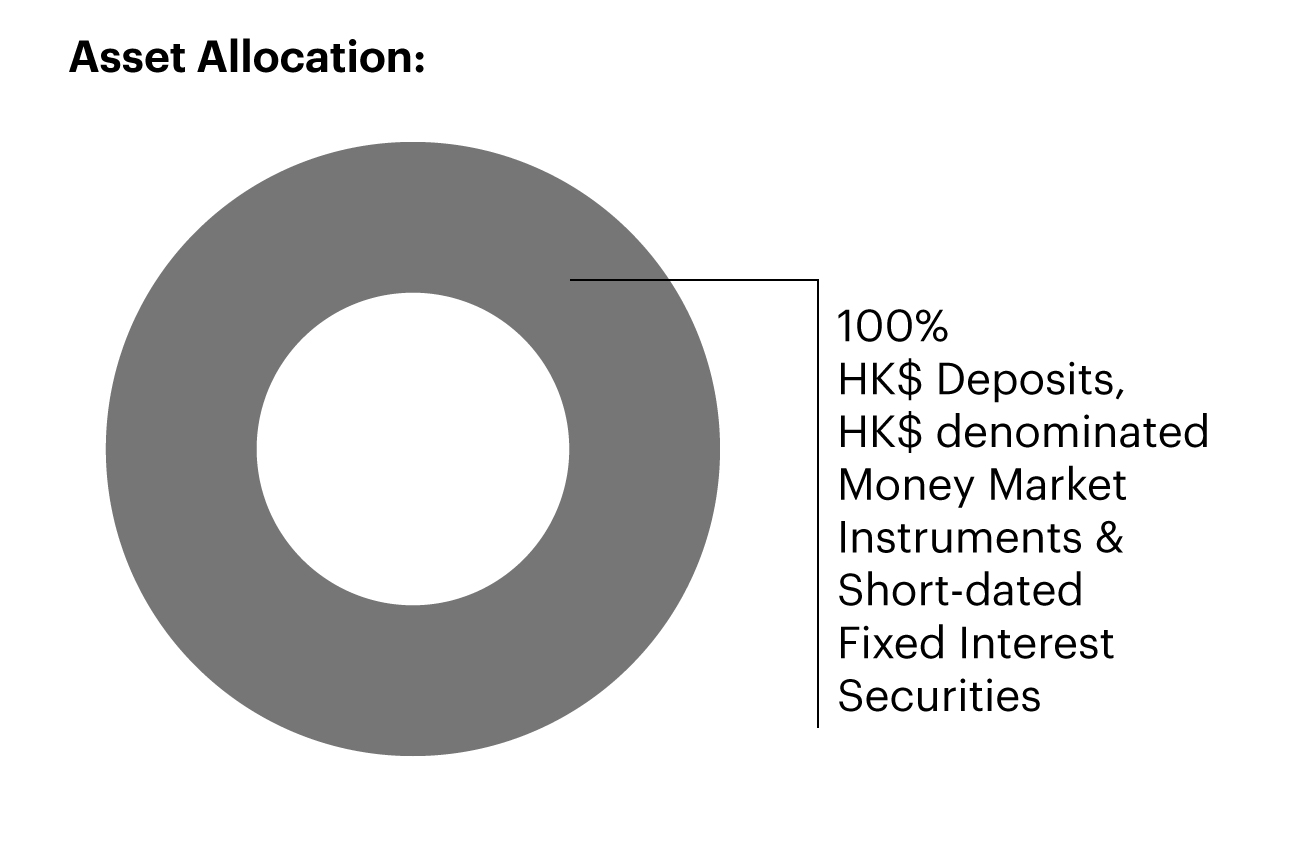

Invesco MPF Conservative Fund1

Investment Objective :

To preserve capital with minimal risk.

Risk and return profile^: Minimal

Risk Class*: 2 (As of 31/03/2024)

~ Invesco Global Index Tracking Fund and Invesco US Index Tracking Fund are not ESG funds in Hong Kong.

^ Risk and return profile of the constituent funds is determined by Invesco Hong Kong Limited based on the volatility, investment objectives and asset allocations of the constituent

funds. Generally, higher volatility represents higher risk. Equity funds are of higher volatility when compared to bond funds and money market funds, and thus higher risk. Members

should note that this is provided for reference only, and may be updated periodically based on prevailing market conditions.

Investment involves risks. Past performance is not indicative of future performance. Investors should read the offering documents (including the Key Scheme Information Document and the MPF Scheme Brochure) for details, including the fees and charges, risk factors and product features.

1 The Invesco MPF Conservative Fund is not subject to the supervision of the Hong Kong Monetary Authority. Investment in the Fund is not equivalent to placing funds on deposit with a bank or deposit taking company. The Fund does not provide guarantee on capital. The rights to benefits of a member in the Fund are limited to price of the units at redemption, which may be more or less than the price at which such units were purchased.

All fees and charges will only be payable out of the Fund to the extent permitted by relevant MPF Regulations, there is possibility that fee deductions would affect the net investment

return. Please note that where a Fund has cash holdings which are held by various financial institutions, such cash holdings will be subject to counterparty risk of such party.

* (i) The risk class is assigned to each constituent fund according to the seven-point risk classification which is based on the latest fund risk indicator of the constituent fund;

(ii) The risk class is prescribed by the Mandatory Provident Fund Schemes Authority according to the Code on Disclosure for MPF Investment Funds;

(iii) The risk class has not been reviewed or endorsed by the Securities and Futures Commission; and

(iv) Volatility is measured by the annualized standard deviation of the fund, based on its monthly rates of return over the past 3 years. Funds with performance history of less than

3 years since inception to the reporting date of the Fund factsheet is not required to show this item.

Risk Class

Fund risk indicator

Risk Class Equal or above Less than

1 0.00% 0.50%

2 0.50% 2.00%

3 2.00% 5.00%

4 5.00% 10.00%

5 10.00% 15.00%

6 15.00% 25.00%

7 25.00% -

5ee082563144a90027d3fcbb

https://api-live.clare.ai

5ea81128dd3860002906b29d,5e8c92fa0c4fde00274f7c2d

Disclaimer:<br><br>INVESBot is not operated by a human person and therefore may not provide the right responses.<br><br>For your own protection, please do not provide your personal information to INVESBot as it will not be recognized or processed. The information that you enter through INVESBot will be stored automatically for as long as it is necessary (generally up to 25 months) only for the purposes of understanding user behavior, troubleshooting, reviewing the accuracy of and refining the responses provided by INVESBot, generally improving the programmed questions and answers in INVESBot and for no other purpose. If you enter personal information into INVESBot you are deemed to consent to such information being stored for such purposes.

Invesco Strategic MPF Scheme (the "Master Trust") currently offers the Default Investment Strategy and 12 Constituent Funds, comprising the following fund types: equity fund (including index- tracking fund), bond fund, money market fund, guaranteed fund and mixed asset fund.

The Guaranteed Fund of the Master Trust invests solely in an insurance policy issued by Principal Insurance Company (Hong Kong) Limited, which is also the guarantor (the "Guarantor"). Your investments in the Guaranteed Fund are therefore subject to the credit risk of the Guarantor. The Guarantor of the Guaranteed Fund will provide a guarantee of capital and a prescribed guaranteed rate of return only (i) if a qualifying event occurs and the Guarantor receives a valid claim or (ii) in other situations (as described in the appendix to the MPF scheme brochure). You should read the MPF scheme brochure carefully before investing in the Guaranteed Fund. Please refer to the risk factors section and the appendix of the MPF scheme brochure for details of the credit risk, guarantee features and guarantee conditions.

The MPF Conservative Fund of the Master Trust does not guarantee the repayment of capital.

Fees and charges of an MPF Conservative Fund can be deducted from either (i) the assets of the fund or (ii) member's account by way of unit deduction. The MPF Conservative Fund of the Master Trust uses method (i) and, therefore, unit prices/NAV/fund performance quoted have incorporated the impact of fees and charges.

You should consider your own risk tolerance level and financial circumstances before taking any investment choices or invest according to the Default Investment Strategy. When, in your selection of funds and/or the Default Investment Strategy, you are in doubt as to whether a certain fund and/or the Default Investment Strategy is suitable for you (including whether it is consistent with your investment objectives), you should seek financial and/or professional advice and make investment choice(s) most suitable for you taking into account your circumstances.

In the event that you do not make any investment choices, your contributions made and/or accrued benefits transferred into the Master Trust will automatically be invested in accordance with the Default Investment Strategy, which may not necessarily be suitable for you. Please refer to the section headed "Default Investment Strategy" for further information.

Investment involves risks. Past performance is not indicative of future performance. You should not invest solely based on the information provided in this section and should read the MPF scheme brochure for details, including the risk factors and product features.

You are encouraged to read our Site-Policies for the terms that apply to your use of this website.