HAPFS - Investment Choices

The Scheme offers six fund choices across the risk and return spectrum by varying the investment mix of equities, bonds and cash. You can invest in different funds according to your

personal circumstances, investment objectives and needs.

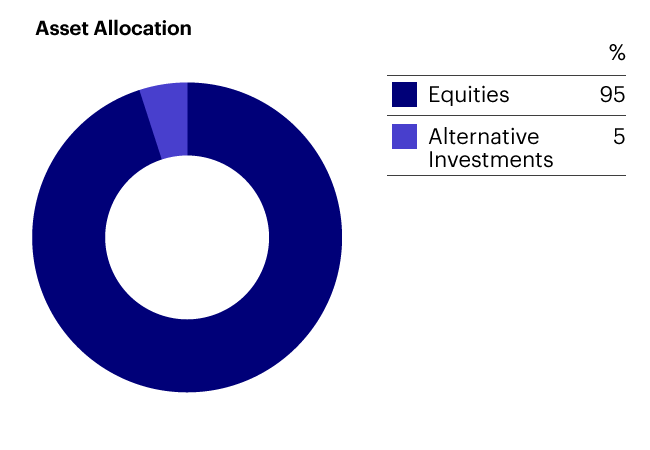

Global Equity Fund

Investment Objective :

- To earn long-term capital appreciation by investing primarily in global equities with a bias towards Hong Kong and China markets.²

Risk Profile^: Very High

Suitable for :

- willing to take high risk for higher potential returns over a longer investment horizon

- relatively early in their career and very long horizon to retirement

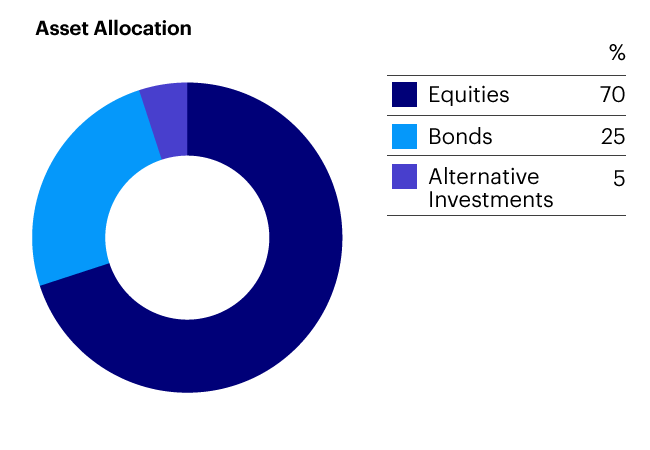

Growth Fund

Investment Objective :

- To earn long-term capital appreciation by investing in an equity-biased portfolio with risk control through global diversification.

Risk Profile^: High

Suitable for :

- willing to take a higher level of risk for higher potential returns over a longer investment horizon

- relatively long horizon to retirement

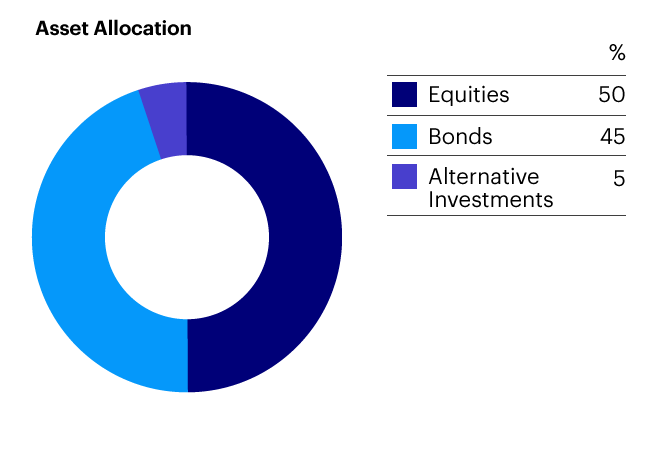

Balanced Fund

Investment Objective :

- To earn long-term capital appreciation by investing in a diversified portfolio of equities and bonds.

Risk Profile^ : Medium-High

Suitable for :

- willing to take a medium level of risk

- in the middle of working lives

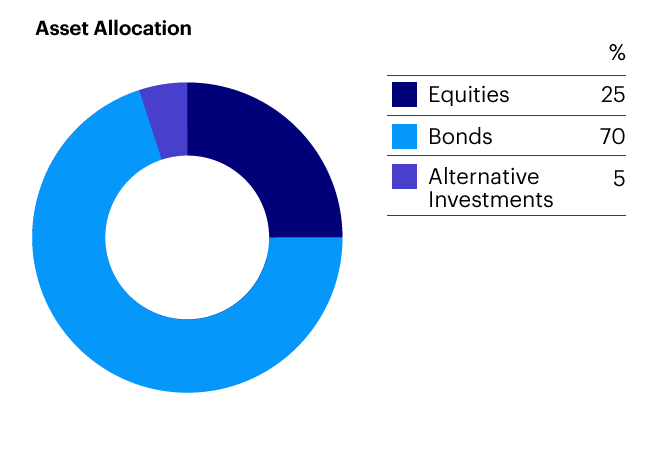

Conservative Fund

Investment Objective :

- To earn stable income while retaining some long-term capital appreciation opportunity by investing in a diversified, bond-biased portfolio.

Risk Profile^ : Medium

Suitable for :

- moderately conservative and willing to assume some level of risk

- mature and approaching retirement in a few years’ time

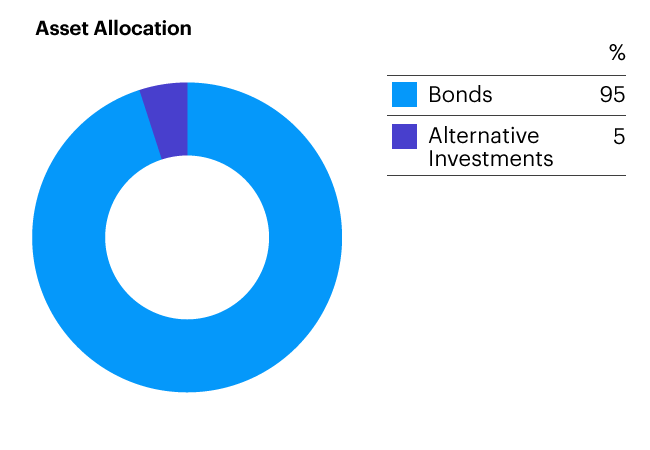

Global Bond Fund ¹

Investment Objective :

- To earn stable income by investing primarily in global bonds with a target to achieve returns in line with global bond markets.

Risk Profile^ : Low-Medium

Suitable for :

- moderately conservative and willing to assume some level of risk

- mature and approaching retirement in a few years’ time

Money Market Fund ¹

Investment Objective :

- To earn low return with low risk by investing primarily in short-term fixed income and money market instruments with a target to achieve returns in line with HKD savings rates.

Risk Profile^ : Low

Suitable for :

- conservative with very low risk appetite

- near retirement

Note: There is no guarantee of capital preservation. The Fund may experience a very small negative return in very

low interest rate environment after deduction of expenses.

Time Deposit Fund 1

Investment Objective :

- To earn return with low risk by investing primarily in time deposits with a target to achieve returns in line with HKD time deposit rates.

Risk Profile^: Low

Actual Deposit rate (after deducting expenses*) for the March 2024 Time Deposit Fund:

| Time Deposit Fund 1M | 5.04% p.a. |

| Time Deposit Fund Series 24-04-03M | 4.36% p.a. |

| Time Deposit Fund Series 24-04-06M | 4.48% p.a. |

| Time Deposit Fund Series 24-04-12M | 4.41% p.a. |

Actual Deposit rate (after deducting expenses*) for the December 2023 Time Deposit Fund:

| Time Deposit Fund Series 24-01-03M | 5.00% p.a. |

| Time Deposit Fund Series 24-01-06M | 4.76% p.a. |

| Time Deposit Fund Series 24-01-12M | 4.46% p.a. |

Suitable for :

- conservative with very low risk appetite

- near retirement

For historical fund prices of time deposit fund, please refer to here.

Note: There is no guarantee of capital preservation. The Fund may experience a very small negative return in very low interest rate environment after deduction of expenses.

* Members who had invested in time deposit funds but did not make switching instructions before the funds matured, will be automatically invested in the 1-month Time Deposit Fund until switching instruction to other fund option is made.

Disclaimer for HKD Time Deposit Fund under Hospital Authority Provident Fund Scheme (HAPFS)

¹ Time Deposit Fund, Money Market Fund and Global Bond Fund involve earning income gradually and may not beat inflation.

² All funds with equity exposures (Conservative Fund, Balanced Fund, Growth Fund, Global Equity Fund) would have such bias to HK/China equity.

^ Risk Profile of the Funds is determined based on the volatility, investment objectives and asset allocations of the Funds. Generally, higher volatility represents higher risk. Equity funds are of higher volatility when compared to bond funds and money market funds, and thus higher risk.

None of the above fund choices provide any guarantee of repayment of capital. It is also useful to note that the risk/return profile is based on strategic asset allocation of equity and bond within a portfolio, and the historical returns and volatility of the two asset classes. It is for reference only.

Investment involves risks. Past performance is not indicative of future performance. Investors should read the relevant prospectus for details, including product features and risk factors.

Remember that everyone is unique. The investment strategies suggested above are for your reference only. Investors should not invest in the Products solely based on the information provided here. You should consider your own risk tolerance level and financial circumstances before making any investment choices. When, in your selection of funds, you are in doubt as to whether a certain fund is suitable for you (including whether it is consistent with your investment objectives), you should seek financial and/or professional advice and choose the fund(s) most suitable for you taking into account your circumstances.